From China to Nigeria: Global Supply Chain Diversification in 2025

15 April, 2025

For decades, China has been the world’s manufacturing powerhouse. However, global manufacturers have begun to search for alternative supply chain ecosystems, with Africa and in particular, Nigeria, emerging as a prime option.

Guinness Headquarters in Lagos, Nigeria | Nairametrics

Already, technology companies like Apple, Huawei and Samsung are diversifying production, and automakers like Volkswagen, Toyota and Nissan are expanding to North Africa, West Africa and South Africa respectively. Companies like Germany’s BASF and Great Britain’s Unilever have found a home for their production facilities in Nigeria. USA’s Kellogg’s has built its 2nd manufacturing plant in Africa, located in Nigeria’s economic center of excellence, Lagos, where it caters to both local and export markets. These are just a few examples of the multinational FMCG companies taking advantage of new frontiers.

According to a 2023 Kearney report, over 96% of U.S. companies surveyed are reassessing their supply chains to reduce reliance on China. This shift has sparked growing interest in EMEA with a keen focus on Sub-Saharan Africa. With abundant labour, improving infrastructure, and regional trade agreements like AfCFTA, Africa is positioned—not just geographically—as the next frontier for global manufacturing investment connecting the global east to the west and vice versa.

A sample of U.S. Companies that have expanded into Africa in the last decade

Here are some of the factors fueling this shift from China:

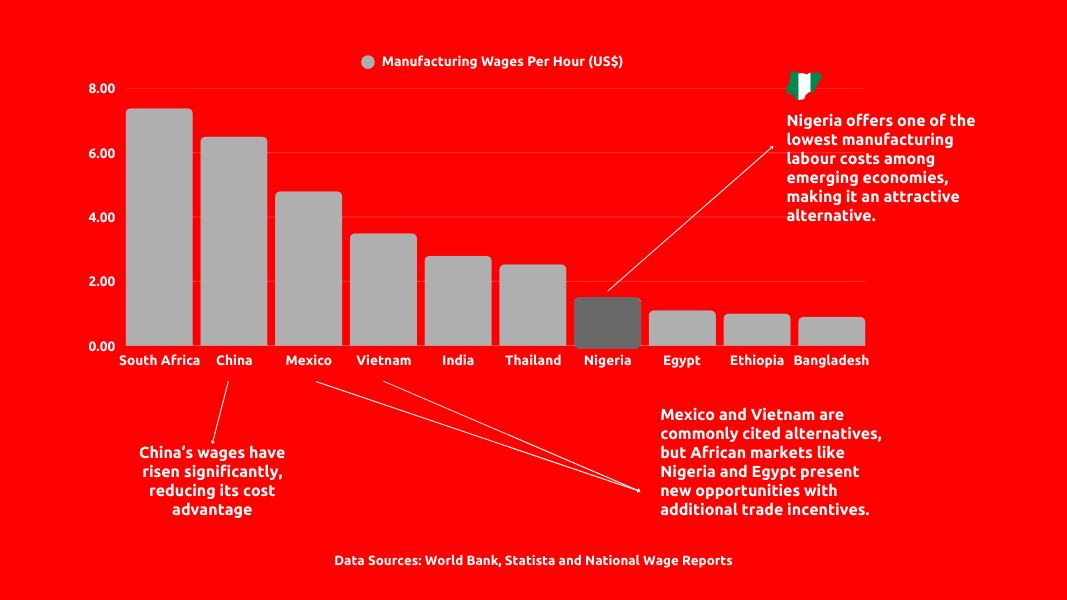

- Rising Costs of production in China: The average manufacturing wage in China has surged from $1.20 per hour in 2005 to over $6.50 per hour in 2024, reducing its cost advantage over emerging markets.

- Trade Tariffs and Policies: Trade policies such as increasing tariffs on goods imported into the US from China lead to increasing costs for manufacturers reliant on China and ultimately for end users/consumers.

- Supply Chain Disruptions: The COVID-19 pandemic and subsequent geopolitical tensions have demonstrated the risks of over-concentrating production in one region. Businesses now prioritise supply chain resilience and diversification.

China vs. Emerging Markets Manufacturing Wages Per Hour (2024)

A strategic alternative for global manufacturers

Africa is now an attractive option for international manufacturers, with Nigeria leading the charge due to its strategic location, population, market potential, and policy-driven industrial reforms. Several factors make Nigeria a compelling choice for global investors:

BASF Facility Within Lagos Free Zone

1. Cost-effective manufacturing

Nigeria offers significantly lower labour costs compared to China and other Asian economies, making it an ideal location for cost-conscious manufacturers. The government continues to invest in skill development programmes to enhance the quality and quantity of the workforce.

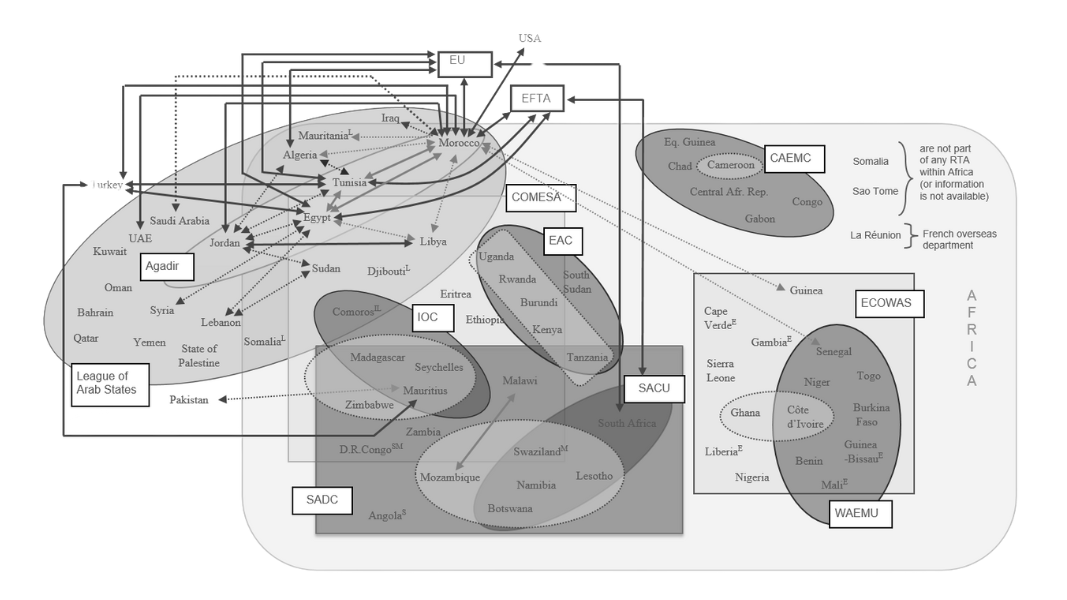

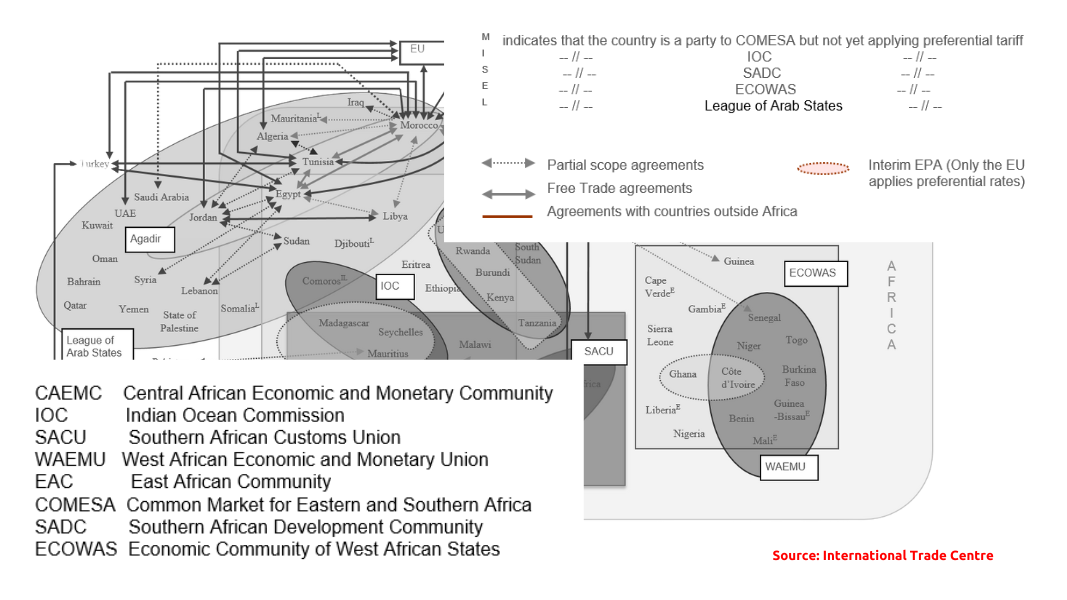

2. Strategic access to markets

Nigeria is not only one of Africa’s largest economies but also a gateway to the continent’s 1.54 billion consumers. Manufacturers setting up in Nigeria automatically gain access to the largest domestic market in Africa, which serves as a strong launchpad before expanding into the rest of the continent. With the African Continental Free Trade Area (AfCFTA) in effect, manufacturers in Nigeria also access duty-free trade across other African nations.

Trade Agreements in Africa Showing AfCFTA Market Access

Government incentives for manufacturers

The Nigerian government has introduced favourable policies, including tax holidays, import duty exemptions, and special economic zones (SEZs) laws, setting the stage for companies like the Lagos Free Zone (LFZ) to attract foreign investment. The LFZ offers investors:

- A one-stop business registration and approval process

- 100% foreign ownership rights

- Unrestricted profit repatriation

- World-class infrastructure tailored for industrial operations

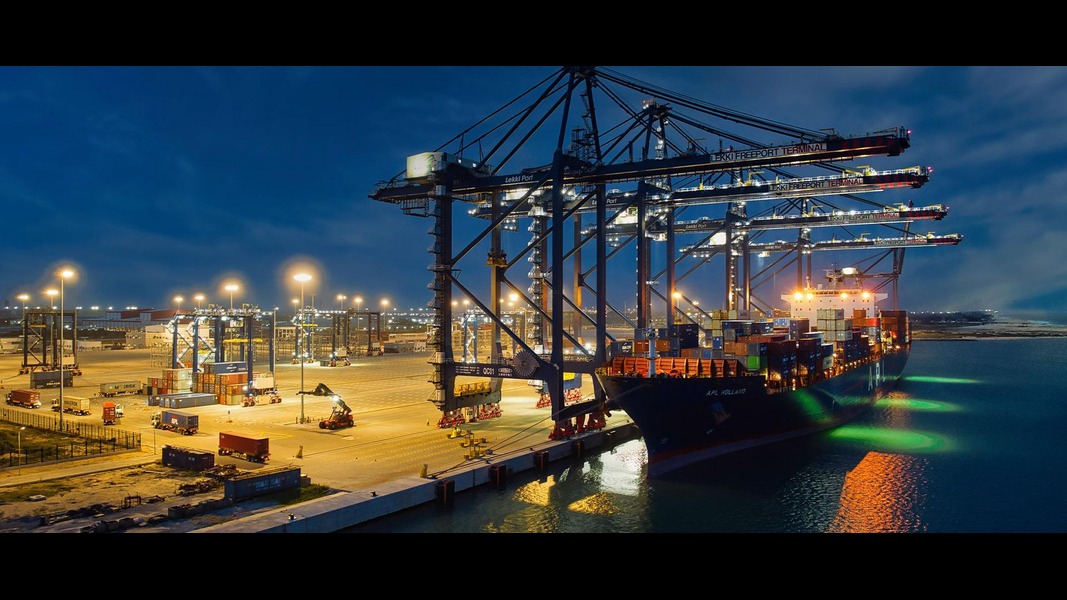

Infrastructure and industrial zones

One of the major concerns for manufacturers relocating their operations to a new region is availability and quality of core and support infrastructure. Lagos Free Zone is an industrial and commercial hub, designed to address these concerns, offering:

- Integration to the Lekki Deep Seaport, one of the deepest ports in West Africa, allowing for cost and time efficient import/export logistics.

- Reliable Power Supply, an issue mitigated within LFZ’s industrial ecosystem with the availability of a captive gas based power plant.

- Integrated Transport and Logistics Hubs, reducing transportation costs and improving efficiency.

- Customer Support & Regulator access, providing greater ease of operations

- Support facilities, such as a medical centre, fire station, serviced apartments, truck parks, fitness centre etc. in one location.

Lekki Deep Seaport Located in the Lagos Free Zone

Nigeria’s manufacturing catalyst

In summary, the shift from China to Nigeria is driven by a combination of increased cost efficiency, market access, and supply chain resilience. With industrial hubs like the Lagos Free Zone offering a business-friendly environment, Nigeria is positioning itself as a global manufacturing powerhouse.

Are you ready to explore investment opportunities in Nigeria’s booming manufacturing sector?